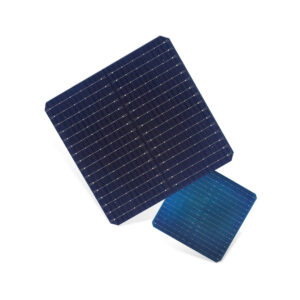

TOPCON technology is still on track to replace mono-PERC as the next mainstream PV technology,Sainty start to produce TOPCON from Sept,2023.

The PV industry is going through a transformational phase in 2022, impacting on all leading players in the upstream and downstream segments. At the heart of these changes are developments relating to PV technology and what the landscape for module supply will be 2-3 years out.

This article explains how productivity of newly ramped TOPCON cell lines and capital expenditure (capex) into heterojunction (HJT) fabs in 2022 are underpinning the move from the industry’s workhouse cell substrates (p-type) to higher quality and performing n-type variants.

These two topics are now essential to understand, and how the somewhat competing architectures (TOPCON and HJT) will evolve during 2023 to 2025. Ultimately, this will redefine what mainstream PV (module) technology offerings will look like during the 3-year period from 2024 to 2027.

Below also, I discuss the forthcoming PV CellTech Extra conference, to be held online during 11-13 October 2022: how the sessions have been structured to explain the new n-type cell technologies that are progressing at the mass production level; and what new research-driven process flows are making the biggest impact now.

Heterojunction in China-investment mode in 2022

Record levels of capex have been invested into new HJT lines in 2022, almost all based upon new Chinese companies (or largely inexperienced PV manufacturers) trying to carve out a technology niche within an already highly competitive landscape.

Announcements (MOUs, intentions, aspirations) have been plentiful during the past couple of years within China. Of course, many are speculative and will not come to fruition. But many are real, and have led to HJT being given a level of priority that is perhaps not merited when looking at productivity and module supply globally right now.

The case for HJT is certainly not as pronounced as it was 20 years ago when the industry was mostly making p-type multi cells with efficiencies in the mid-teens, and two companies (SunPower and Sanyo) were kitting out a GW-levels based on IBC and heterojunction lines. Then, the arguments to move to the higher performing n-type platforms were significant. The reason the industry did not follow these companies was a combination of technical know-how and production cost barriers.

As far as HJT evolved in this first technology wave, Sanyo was bought by Panasonic, and slowly the company’s activity as a cell producer was deprioritized and eventually terminated.

To use the same narrative for HJT today is misplaced. There is no longer a significant delta when looking at other mainstream options, in particular the more mature TOPCON (previous n-PERT) activity. More on this below in the TOPCON section.

In fact, even if TOPCON was not making such massive steps in the market today, HJT would still justifiably be a candidate for the next technology step in the market after p-mono PERC. But what has happened with TOPCON in the past 12 months now puts HJT under massive pressure to show results: not just from a production standpoint, but from a profitability perspective. Until now, no-one has demonstrated making HJT cells/modules with profits.

Therefore, HJT is still a technology waiting to be proven. And 2023 will definitely be the year in which we will know if HJT can co-exist in high volume alongside TOPCON over the next five years, or will be confined to the history books alongside a-Si, CIGS and possibly IBC (if Maxeon decides to terminate Asian production and transition fully to p-type mainstream PERC-based offerings).

For the HJT supporters, there are several sides to the 2023 picture. By far, the most activity (investments, new players) is in China: Chinese companies (many of whom are new to solar) buying Chinese production equipment. However, the balance of power, so to say, is firmly in the hands of their equipment suppliers right now.

From the number of HJT proponents in China today, by far the most advanced is Huasun. New to PV manufacturing and heavily engaged with equipment suppliers both in Europe and China, the company was successful in getting a utility-scale deal outside China (in Eastern Europe).

In seeking to have overseas business with a differentiated technology (and also as first mover from China). Huasun is probably the test-bed for HJT in China: success in ramping lines, shipping quality cells/modules, and making profits could quickly be spread by cross-pollination to the domestic HJT eco-system. Behind the scenes, this seems to have been the way that TOPCon got kick-started (at the multi-GW level) within China.

A quick side note on the equipment-supplier relationship mentioned above for HJT in China: technologies pushed by equipment suppliers to the market (and where the technical IP/expertise resides with the tool makers) have tended to end up in tears in the PV industry. Cell makers ultimately need to own knowledge and be in control of their own destinies. Remember Applied Materials, Oerlikon, ULVAC…

Outside China, there are three credible HJT companies right now: Hevel, REC Group and Meyer Burger. Each has been advocating the technology for years, but in 2023 each now needs to show evidence of volume production (GW-plus) with profitability. Let’s look now at these companies from a HJT value-added perspective.

Hevel (as part of parent company investments into upstream and downstream PV activities) is probably the most successful HJT cell producer in the Western world today. Largely benefiting from its transition from a-Si to HJT, Hevel had to almost single-handedly invest in R&D to make the technology change work. Over the next 18 months, the move to an integrated ingot-to-module GW-scale HJT fab (through the EnCORE PV vehicle) should become a reality, and ramping this up and being competitive (and profitable) in the PV industry landscape at the end of 2023 then become the metrics that will determine the company’s HJT growth out to 2025 and beyond. Interestingly, Hevel/EnCORE has the scope to be both a HJT cell or module supplier, something that is not on the cards for the other non-Chinese HJT companies mentioned above.

Meyer Burger is still at the early stages of its rebirth as a cell/module manufacturer (and not equipment supplier). Similar to Hevel, there are no concerns regarding technical know-how when it comes to HJT – Meyer Burger has been making HJT equipment for a long time and the legacy focus on supplying turn-key cell lines is almost the perfect stepping-stone into mass production mode. Most of the outstanding questions relate to the company’s long-term operational health and its ability to make money selling HJT modules; Meyer Burger has no other revenue streams to rely on. Making profits selling HJT modules is the only route to succeed. One key advantage of Meyer Burger HJT modules however is the ability to have a 100% non-China supply-chain (polysilicon, ingot/wafer, cell/module); important for the U.S. market now, other regions (and global corporate buyers) will align soon to have full traceability on manufacturing.

REC Group – not for the first time in 20 years – is going through another transitional phase today. The company’s shift to HJT is yet to be fully enabled. Originally, the company was a p-multi champion, and got dragged into mono by the dominance of the Chinese solar segment several years ago. Then there was a push to offer n-PERT/TOPCON to the industry. Then an arrangement of sorts was announced with Meyer Burger (then selling HJT turn-key lines) that did not work out. And finally, the company went to China to buy a turn-key line for a renewed HJT push. And during this time, the company changed from being Chinese-owned to Indian-owned. 2023 is the year that production for HJT has to be the only metric that will show the outside world that HJT is central to long-term plans. Interestingly though, the previous push for PERT/TOPcon may be significant, and if the market looks like it will move to TOPCON, the company should be able to make this change easily.

Therefore, with HJT, there are many different initiatives on the go. Both inside China and globally. At the end of 2023, it will be much clearer which companies have gained a foothold in the n-type transition phase.

But ultimately, it could be that TOPCON developments move at a faster rate than any of the HJT advocates can keep up with. So, let’s talk TOPCON now.

TOPCON still on track to replace mono-PERC as the next mainstream PV technology

It should be noted first that TOPCON is just the current acronym in vogue to categorise solar cells that use n-type substrates and are based on the more conventional front/rear side deposition processes that have been the backbone of PV manufacturing until now.

The use of n-type substrates is not new, in terms of a smooth ‘upgrade’ to the standard p-type cell process flow. The first major commercial drive in this respect was when Yingli Green (then the leading module supplier globally) ‘partnered’ with ECN and Tempress (then part of Amtech Systems) in what was marketed as the PANDA technology. At this point, nomenclature for solar cells was not yet in vogue, although the basis of the PANDA technology was essentially the passivated emitter, rear totally diffused (PERT) structure.

Various other cell manufacturers tried to introduce n-type cells to the market over the years, with the largest investments being when LG Electronics bankrolled efforts to be a solar module brand. By this time, process flow changes to the n-PERT structure had resulted in a new acronym being adopted: TOPCON.

Ultimately, none of the early efforts succeeded but a huge amount of R&D and pilot-line learning had taken place. Crucially also, p-type mono had become a highly sophisticated cell type that made the transition from p-type mono PERC to n-type TOPCON an obvious (and extremely low risk) step.

This is now where JinkoSolar and JA Solar enter the story. I have commented extensively on PV-Tech and at various other events over the past 18 months that these two companies are the ones that are defining technology in the PV industry now. What these two companies decided to do after p-mono PERC was almost certain to set the benchmark for everyone else.

Long-story-short, Jinko and JA adopted TOPCON; and 2021/2022 has seen massive investments by these companies in TOPCON (from ingot-to-module) as the chosen technology over the next 3-5 years. Regardless of any scientific arguments, or competing-technology aspirations, if Jinko and JA choose TOPCON, one could argue that the next mainstream technology shift has been decided.

The only remaining piece of the puzzle here is actually what Tongwei and Aiko do next. These two companies feed most of the other module suppliers globally. Neither company drives technology change: they are low-cost China-centric solar cell enablers that make what module suppliers need to be competitive. I fully expect Tongwei and Aiko to be TOPCON-driven in 2023. If so, then perhaps the question of the next mainstream PV technology (going out five years) is a done-deal. HJT may still have a role for GW-level cell/module producers, largely because the industry by then will be well above the 300 GW annual level.

But, lots of conditions and speculation here! For now, this is my most likely technology roadmap for the sector. JinkoSolar, JA Solar, Tongwei and Aiko are the ones to watch.

Furthermore, if production in 2022 is anything to go by, TOPCON is the winner. If module supply (based on contractual deliveries globally) for 2023-2024 is a signal, again TOPCON is the only game in town. Looking now at arrangements (contracts) in place for volume shipments globally in 2023 and 2024, the only n-type technology being backed is TOPCON. (Yes, there are HJT ‘deals’ being done, but high risk and not from any of the major global module suppliers today.)

So, at least for now, one would be brave to bet against TOPCON being the next mainstream acronym after PERC. But technology is not static and far from standardized. In this respect, using catchy terms is good but also masks the physics at play in manufacturing. This potentially becomes even more topical when the industry starts to move beyond the single-junction cell that (aside from a few solar cells in space!) has enabled solar to be an energy source of value in 2022. In this respect, everything being done today to push PERC to any PERC+ variant, or to move HJT to the GW-scale production stage, is only going to help when the real shift in cell technology happens later this decade as the industry moves to tandem or hybrid concepts.

Technology advancement has never been so impressive in the PV industry. And this is where Chinese companies have to take all the plaudits. Twenty years ago, the PV industry had a group of Western (European, Japanese, U.S.-based) equipment suppliers that taught the first wave of Asian producers how to make entry-level solar cells. During the past 10 years, Chinese manufacturing has shown the world how to move to advanced cell concepts at lightning speed. Module buyers may hate the fact that product datasheets change every few months, but how these same buyers are benefiting hugely from the improved products on offer. In this respect, if TOPCON becomes mainstream or TOPCON and HJT co-exist globally come 2025, then it is Chinese innovation that will be a key factor behind this.

Introducing PV CellTech Extra – an online global technology webinar feast!

Launched in 2015, the PV CellTech events have become the go-to annual event for PV technology in manufacturing, focusing specifically on solar cell mass production issues, market-leaders’ technology roadmaps, and identifying advanced concepts being introduced today that will be mainstream options 2-3 years out.

Looking back over seven years of PV CellTech, I still can’t believe how much the industry has supported this type of event. Years ago, I remember countless discussions with my colleague at PV-Tech, Mark Osborne, on how the industry was lacking a quality manufacturing conference where CTO’s went on stage and explained technology. We mapped out a concept, mainly based on what we had both seen work in adjacent technology segment.

Since 2015, it is incredible how much technology has been accelerated within the PV industry: hearing financial analysts ask me when perovskites will become mainstream; getting quizzed by institutional investors about the differences between LID and LeTID. Five years ago, the same audience was telling me that PV modules were a commoditized product and the only thing that mattered was getting cheaper me-too products going forward.

Post-pandemic, we moved the flagship annual in-person event from Malaysia to Germany (in March 2022). However, there is now a massive and growing global interest in solar cell technology, a diverse audience wanting to know when the pilot lines of today will feed into utility-scale module availability from 2024 onwards. Therefore, we are now going to hold an annual online version of the in-person event; this is called PV CellTech Extra. Imagine three days of webinars from the cell market leaders, equipment-suppliers and technology-transfer research labs.

PV CellTech Extra will take place on 11-13 October 2022, and details on how to sign up to hear the talks can be found here.

Day 1 focuses purely on TOPCon in manufacturing and how this technology will evolve 2-3 years out. Day 2 is specific to heterojunction. And Day 3 is dedicated to PERC-Plus and hybrid/tandem/perovskite technologies.

Collectively, the range of presentations should give everyone a full understanding of what to expect going forward in terms of modules to the market in the near to mid-term, and hopefully at the end of the week we will all be a bit further ahead in terms of understanding all the questions today relating to TOPCon and HJT!

We are looking forward to the debut of Sainty SOLAR.

From https://www.pv-tech.org